Meta Description

Apple Pay’s user base has recorded remarkable growth since its inception, boasting 507 million users globally. Its revenue between 2019 and 2022 has also surged significantly, moving from $998 million to $1.9 billion during the same period.

How Many Users of Apple Pay Are There in 2023?

As the popularity of mobile payment solutions increases, Apple Pay surfaces as a key player in the market, distinguishing itself from the rest.

This service was introduced in 2014 and has How Many Users of Apple Pay exhibited remarkable growth, transforming the way people make payments and transact using compatible Apple devices. In essence, the Apple Pay payment system makes such processes secure and seamless without physical meetings.

But while Apple Pay’s dominance in the market is notable, it’s also vital to acquaint yourself with the number of users adopting this service. In that regard, the United States has the highest number of users. How Many Users of Apple Pay Data shows that there are 507 million global Apple Pay users, of which the US accounts for 45.4 million.

This is evident in recent data revealing five out of ten US respondents identifying as users of Apple Pay in a restaurant or store between August 2020 and August 2021. Notably, the payment system’s How Many Users of Apple Pay security features, convenience, and contactless features are what contributed to its service’s popularity.

Read More: Cryptocurrency Wallet

This article equips you with the key statistics you must know about the Apple Pay user base in 2023.

Key Points:

Apple Pay is the most used mobile payment service in the US, with half of the surveyed citizens identifying its usage in restaurants and stores within a year.

There are roughly 45.4 million How Many Users of Apple Pay in the United States alone in 2023, with an estimated one in every five US citizens using the service.

Apple Pay’s convenience and security features are the major driving forces of its adoption among users.

The contactless payment function of the Apple Pay service is its main appeal to most customers.

A Brief Look at Apple Pay

Apple Pay, a mobile payment system and digital wallet from Apple Inc, has recorded significant global popularity. This growth results from the diligent efforts of the company to craft a user-friendly and How Many Users of Apple Pay secure payment platform that harnesses the strength of NFC technology.

Apple seamlessly integrated its payment system into the financial landscape through strategic partnerships with leading banks, credit card providers, and payment processors.

Regarding its revenue stream, Apple Pay gets its funding from transaction fees imposed on merchants and the interest accrued from funds within Apple Pay Cash accounts. In 2022 alone, it raked in an impressive $1.9 billion in revenue, with projections indicating a How Many Users of Apple Pay substantial leap to $4 billion by 2023.

Additionally, financial institutions are charged fees for participating in the Apple Pay network, while a percentage of transaction values paid by card-issuing banks contributes to its earnings.

Notably, the payment system diversifies its income sources by capitalizing on in-app purchases and a credit card offering tagged Apple Card. The Apple Card generates revenue through interest, interchange, and late fees.

Apple Pay Users: What is the Number of Apple Pay Users in 2023?

Dating back to 2020, Apple Pay recorded an estimated 66 million new users. Predictions had it that this payment system How Many Users of Apple Pay could be up to 19.7%, reflecting the possibility of having one user out of every five individuals.

This can be attributed to the growing number of global iPhone users activating the payment system, How Many Users of Apple Pay already surpassed 65 million in 2020.

Regarding worldwide card transactions, Apple Pay accounts for 5%, with predictions that it will hit 10% by 2025. How Many Users of Apple Pay This doesn’t only reveal the service’s increasing usage; it also points out the potential revenue Apple’s digital wallet can generate for the company.

Let’s highlight some interesting facts regarding Apple Pay usage:

In a survey, two out of ten United States respondents cited using the Apple Pay service for online shopping.

Among the 100 top American retailers, 28% offered the payment system on desktop, 43% on their apps, and 39% on mobile, all in 2020.

Apple Pay holds a market share of 43.9% in the United States.

As of 2021, about six out of every ten How Many Users of Apple Pay people used the service for point-of-sale (PoS) transactions in the United Kingdom.

Where to use Apple Pay as a Payment Option

You can find Apple Pay as a payment option in many places, particularly across the United States. According to information How Many Users of Apple Pay provided by Apple Pay’s official website, over 85% of American retailers have embraced this convenient contactless payment method.

It’s not just limited to one type of location; you can use Apple Pay in diverse settings, both online and offline. How Many Users of Apple Pay This includes vending machines, grocery stores, subway stations, taxi cabs, and more.

Regarding specific businesses, Apple Pay is welcomed at an impressive list of establishments, including well-known names like Costco, Best Buy, CVS, McDonald’s, Dunkin Donuts, How Many Users of Apple Pay Whole Foods, Staples, and Walgreens.

It’s not only tied to retail stores since Apple Pay is also accessible in universities, ballparks, ATMs, and How Many Users of Apple Pay nonprofit organizations. Furthermore, approximately 275 transit systems, including some in China, have integrated Apple Pay for commuters’ convenience.

Who Uses Apple Pay? – Countries and Businesses

Apple Pay has expanded its availability to various regions, including Canada, the United States, the Middle East, Latin America, the Caribbean, Africa, Europe, and Asia-Pacific.

Notably, in 2020, Apple Pay accounted for a substantial 92% of all mobile wallet debit transactions in the United States. In 2021, Apple Pay transactions represented 63% of those who used it at least once in restaurants or retail establishments.

Apple Pay Expansion?

In 2021, Apple Pay made significant strides in its global expansion, venturing into nine fresh How Many Users of Apple Pay markets, such as Israel, Mexico, and Columbia. Alongside this expansion, the payment system How Many Users of Apple Pay introduced the innovative Apple Family Card, an extension of its existing Goldman Sachs Apple Card.

This unique offering enables users to include up to five family members on a single account, enhancing convenience and accessibility for households.

Apple Pay also introduced several noteworthy enhancements to its wallet features. An example is the launch of the How Many Users of Apple Pay university ID program, which allowed students to seamlessly integrate their student IDs into their digital wallets, simplifying campus life.

Additionally, in the United States and Canada, Apple Pay took a step further by incorporating support for health insurance cards, adding a layer of convenience for users in managing their healthcare information.

What is the Future of Apple Pay?

Apple is projecting an ambitious course for the coming years, with significant developments in the pipeline. They could be working on incorporating support for driver’s licenses and State IDs into their wallet feature.

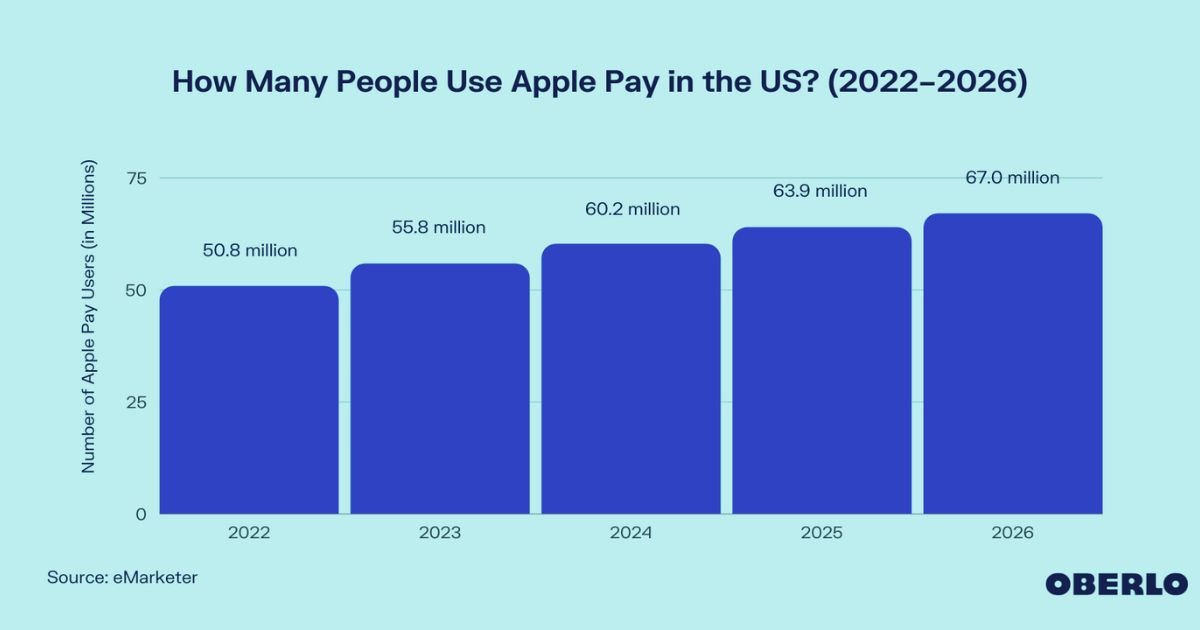

Additionally, the company has successfully launched its buy now, pay later initiative, known as BNPL. How Many Users of Apple Pay While there is speculation that Apple Pay usage might experience a downturn in 2023, it’s worth noting that in 2022 alone, the user base in the United States hit an impressive 45.4 million. Forecasts indicate a further surge in Apple Pay users, with an estimated 54.5 million individuals utilizing the service by 2025.

Apple Pay Annual Revenue

Apple needs to readily release information about its financial details to prioritize customer protection. However, there are some useful estimates found regarding its revenue.

On that note, it’s estimated that Apple Pay generates more than $1 billion annually in fees alone, raising the company’s overall revenue to nearly $20 billion.

As for future revenue streams, that remains uncertain, but this division undeniably contributes to Apple’s overall value.

While we couldn’t pinpoint Apple Pay’s exact valuation, Apple’s quarterly report for the second quarter of 2022 showed How Many Users of Apple Pay revenues of $1.9 billion. However, keep in mind that Apple Pay represents only a fraction of this colossal figure.

Year

Revenue

2019

$998 million

2020

$1.05 billion

2021

$1 billion

2022

$1.9 billion

Apple Pay Usage in the United States

A recent study about the preferences of American customers with mobile payments has taken an interesting turn. For instance, the study shows Millennials have embraced the contactless payment system with enthusiasm, outpacing other generational groups in this regard.

However, what stands out prominently is the remarkable adoption of Apple Pay among Gen Z individuals.

Furthermore, Apple itself has taken proactive steps to fortify the security features of Apple Pay. These enhancements not How Many Users of Apple Pay only bolster the confidence of existing users but also aim to allure new users into the fold.

Among these measures is the sharing of assessments and transaction details with card networks, a strategic move aimed at curbing fraud incidents.

Apple Pay Usage in France

Apple Pay’s popularity isn’t limited to just one region; it’s also making waves in Europe. Data from Statista’s Consumer Insights reveals that six out of ten individuals use Apple Pay in restaurants and stores between April 2022 and March 2023.

When it comes to Apple Pay usage around the world, here are a few eye-opening statistics to note:

In 2022, the global user base for Apple Pay surpassed a staggering 535 million.

Almost 70% of Apple Pay users prefer to make in-store payments, while approximately 35% opt for online transactions.

Next time you make a purchase, keep in mind that you’re part of a vast community of users worldwide who appreciate How Many Users of Apple Pay the convenience and security that Apple Pay brings. Besides, Apple Pay could be more widely embraced than you initially imagined.

What is Behind Apple Pay Adoption?

The surging popularity of Apple Pay can be attributed to several key factors. One major driver has been the widespread adoption of contactless payments, a trend that gained significant momentum during the COVID-19 pandemic.

Throughout 2020, an impressive 66 million individuals embraced Apple Pay, recognizing its appeal in facilitating secure How Many Users of Apple Pay and convenient contactless transactions. This upward trajectory is poised to continue as more people seek secure and hassle-free payment solutions.

Apple Pay’s seamless integration with Apple devices has been pivotal in its remarkable success.

In 2021, 24% of iPhone users opted for Apple Pay when making purchases, underscoring its reputation for convenience and accessibility.

Furthermore, Apple Pay’s extensive acceptance among merchants, with a notable 52% adoption rate in North America, further propels its ongoing expansion in the world of digital payments.

Conclusion

For those who embrace Apple Pay, its versatility shines whether you’re dining out, navigating a shopping spree, or indulging in online retail therapy.

If you’re a devoted Apple device user, How Many Users of Apple Pay unlocking the world of Apple Pay is a must to fully appreciate its robust features for seamless money transfers and effortless transactions.

Besides discovering some intriguing Apple Pay user statistics for 2023, consider this a valuable addition to your knowledge base.

Read More: Apple Pay

FAQs

How protected is Apple Pay?

Apple Pay offers a heightened level of security compared to traditional debit, credit, or prepaid cards. To purchase your iPhone, Mac, Apple Watch, or iPad, you’ll need to use Touch ID, Face ID, or your passcode.

This added layer of security ensures that your card number and personal information remain confidential without being disclosed to merchants. Additionally, your actual card numbers are not stored on your device or Apple’s servers.

For online payments, whether in Safari or through apps, merchants will only receive the specific information you authorize to How Many Users of Apple Pay fulfill your order. As a result, when you make in-store payments, neither Apple nor your device shares your real card number with merchants.

This typically includes details like your name and email address, billing, and shipping addresses.

How can I set up Apple Pay?

Setting up Apple Pay is straightforward. To begin, link a credit, debit, or prepaid card to your iPhone’s Wallet app.

Once done, you can extend this card to other Apple devices, such as Apple Watch, Mac, and iPad. Plus, when you switch to a new iPhone, migrating your cards to the new device is a seamless, one-step operation.

What banks accept Apple Pay?

Apple Pay collaborates seamlessly with a vast array of credit and debit cards issued by banks globally. Its compatibility list is continually expanding, with new additions being made regularly.

Click here to see the list of compatible banks?

You can also explore the comprehensive list of participating banks to discover whether your bank supports Apple Pay. If your card isn’t compatible with Apple Pay, it’s advisable to contact your bank directly for further details and assistance.

Is there special equipment needed for a business to use Apple Pay?

Using the Tap to Pay feature on your iPhone opens the possibility of accepting contactless payments directly through a compatible app.

The convenience here is that you won’t need additional terminals or hardware. If you possess a payment terminal already, it’s advisable to contact your payment service provider to inquire about their support for contactless payments.